WA remained one of Australia’s tightest rental markets in the June 2023 quarter: REIA

28 September 2023"While Perth’s vacancy rate rose in the June 2023 quarter it still remained among the lowest in the country, according to the latest REIA Real Estate Market Facts."

While Perth’s vacancy rate rose in the June 2023 quarter it still remained among the lowest in the country, according to the latest REIA Real Estate Market Facts.

Vacancy rates improved slightly in Sydney (1.5 per cent), Brisbane (1 per cent), Adelaide (0.6 per cent), Perth (0.8 per cent) and Canberra (2 per cent). Hobart (1.8 per cent) and Darwin (3 per cent) recorded stronger increases, while Melbourne decreased (2.1 per cent).

REIWA CEO Cath Hart said strong demand and low levels of supply were keeping Perth’s vacancy rate at near-record levels and while it rose 0.1 percentage points in the June quarter it was likely to tighten further over the course of the year.

“There were some signs the rental market was improving during the quarter, but those green shoots didn’t bear fruit,” Ms Hart said.

“While members are reporting a lot of activity from Eastern States investors and builders are reporting increasing completions, supply can’t keep up with demand.

“Historically, rental listings decline towards Christmas. When you combine this with WA’s strong population growth, we can expect the vacancy rate to decline again."

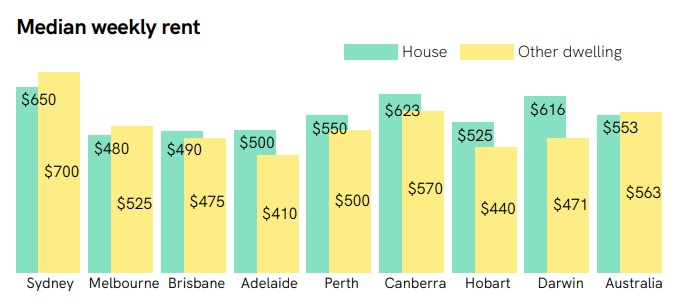

Median rental prices

Perth’s median weekly rent rose 6.8 per cent to $550 for three-bedroom houses.

This was the highest increase across the capital cities. Sydney had the next highest growth rate at 4.8 per cent.

The median rent for other dwellings rose 1 per cent to $500 per week.

Annually the median weekly rent for houses rose 19.6 per cent, again the largest increase among the capitals, and 16.3 per cent for other dwellings.

Median house rent prices: Perth and regional centres

The June quarter saw the median rent for houses increase in all Perth areas: Perth Inner (3.5 per cent), Perth Middle (3.4 per cent) and Perth Outer (3.8 per cent).

It also increased in regional areas, with Bunbury rising 4.9 per cent, Broome up 7.5 per cent and Albany recording 1.1 per cent growth.

The story was the same annually. The median rent for houses rose in all metropolitan areas: with Perth Inner, Perth Middle and Perth Outer up 19.4 per cent, 20.0 per cent and 15.8 per cent respectively.

Regionally, rents increased in in Bunbury (16.1 per cent), Broome (28.2 per cent) and Albany (13.8 per cent).

Under current market conditions, increased are expected to continue throughout 2023.

Median two-bedroom dwelling rent prices: Perth and regional centres

The median rent for other dwellings increased in all metropolitan areas in the June quarter, rising 3.8 per cent in Perth Inner, 4.2 per cent in Perth Middle and 7.1 per cent in Perth Outer.

In regional WA, it increased in Bunbury (35.7 per cent) and Albany (23.9 per cent) but decreased in Broome (-4.5 per cent).

All metropolitan areas recorded an increase in their median rent over the year. Perth Inner rose 18.3 per cent, Perth Middle was up 17.6 per cent and Perth Outer increased 18.4 per cent.

All the regional areas also saw the median rent for other dwellings increase over the year, up 31.9 per cent in Bunbury, 16.7 per cent in Broome and 25.7 per cent in Albany.

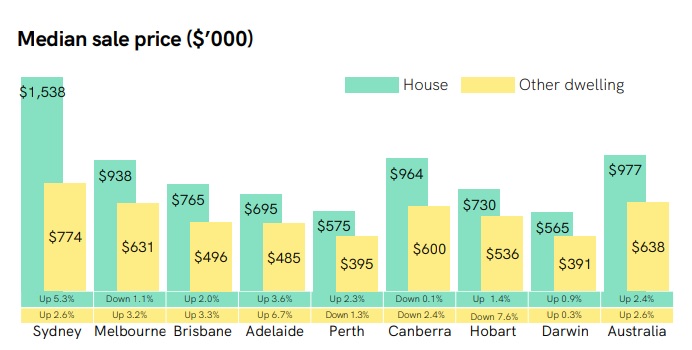

Median sale prices

According to the REIA data, Perth’s median price for three-bedroom houses was $575,000 in the June 2023 quarter, an increase of 2.3 per cent from the March 2023 quarter and 5.5 per cent over the year.

The median price for other dwellings decreased 1.3 per cent over the quarter to $395,000, which was a 1.7 per cent decline annually.

Ms Hart said population growth, rising costs and extended delays in the building industry were underpinning the strong demand for established homes, which was then fuelling price growth.

“We’re seeing homes sell in record times, which highlights the demand for established property,” Ms Hart said.

“Market conditions indicate this will continue and we can expect more price growth over the year.”

Sydney (5.3 per cent) recorded the highest median house price growth over the quarter, followed by Adelaide (3.6 per cent) and then Perth. Melbourne (-1.1 per cent) and Canberra (-0.1 per cent) both recorded declines).

Adelaide (6.7 per cent) saw the most growth in the median price for other dwellings, while Hobart (-7.6 per cent) had the largest decrease.

Perth was the second most affordable capital city by median house price and median price for other dwellings, with Darwin marginally more affordable in both categories. Despite the increase in prices, Perth is also one of the most affordable cities based on the proportion of income needed to meet mortgage payments.

Median house sale prices: Perth and regional centres

Over the quarter, the median house price increased in Perth Middle (1.1 per cent) and Perth Outer (2.7 per cent) but decreased in Perth Inner (-1.2 per cent).

In regional WA, it increased in Bunbury (0.4 per cent) and Broome (7.2 per cent) but decreased in Albany (-3.7 per cent).

Over the past year, the median house price increased in Perth Middle (1.5 per cent) and Perth Outer (7.9 per cent) but decreased in Perth Inner (-5.1 per cent).

Annually, Bunbury (7.3 per cent) and Albany (5.3 per cent) recorded increase in their median house prices, while Broome (-7.7 per cent) saw a decline.

Median two-bedroom dwelling sale prices: Perth and regional centres

Over the quarter, the median price for other dwellings increased in Perth Middle (2.0 per cent) and Perth Outer (3.7 per cent) but decreased in Perth Inner (-1.6 per cent).

Regionally WA, it increased in Bunbury (20.0 per cent) and Broome (5.8 per cent), but decreased in Albany (-38.5 per cent).

Over the past 12 months, the median price for other dwellings increased in Perth Middle (0.4 per cent) and Perth Outer (5.3 per cent) but decreased in Perth Inner (-10.2 per cent).

In the regions, Bunbury recorded an increase (2.4 per cent) in the median price for other dwellings, while the median declined in Albany (-6.8 per cent) and Broome (-6 per cent).