WA rental stress to worsen amid housing shortfall, as more investors exit

4 April 2023"The number of rental properties in WA declined again in March, with Government Bonds data showing the number of rentals have fallen almost 5,000 over the past 12 months."

The number of rental properties in WA declined again in March, with Government Bonds data showing the number of rentals have fallen almost 5,000 over the past 12 months.

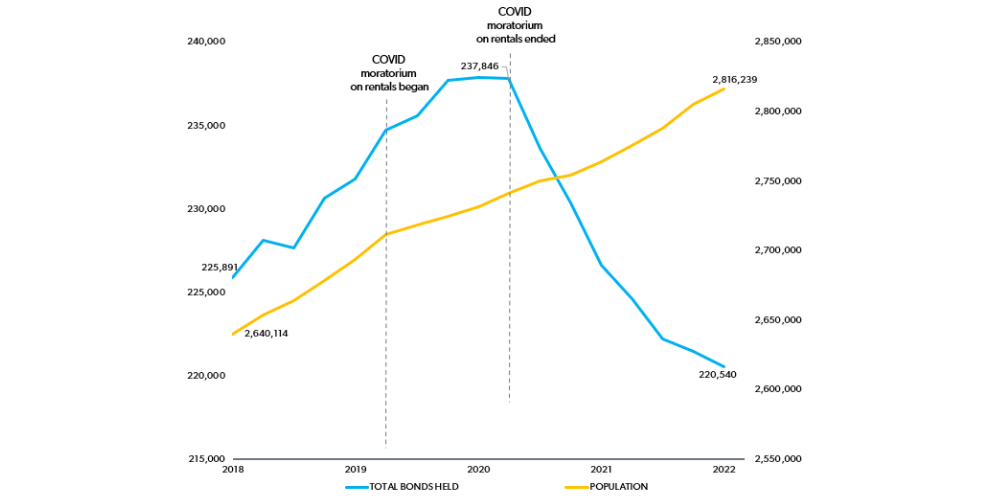

REIWA CEO Cath Hart said the bonds data showed there were 219,679 bonds at the end of March, a loss of 861 properties in 2023 and a decline of 19,000 since the peak in January 2021.

The new figures come after a report from the Federal Government entity charged with improving housing outcomes for Australia revealed WA was facing the largest housing shortfall in the country over the coming five years.

Ms Hart said this would put further pressure on WA’s already fragile rental market.

The report from the National Housing Finance and Investment Corporation (NHFIC) stated WA faced a shortfall of 25,200 new properties from 2023 to 2027, out of a 106,300 dwelling-shortfall nationally.

“The alarming aspect of this report for us is that WA alone was identified as requiring 25,200 dwellings — this is nearly a quarter of the entire national shortfall even though we are only about 10 per cent of Australia’s population,” Ms Hart said.

“It’s a huge concern for our market. Renters will be the most impacted and we can expect the rental crisis to worsen and put more pressure on government housing.”

Ms Hart said supply and a stable regulatory environment were the biggest issues facing the property market.

“While making new properties available is part of the solution, we also need to look at why investors are continuing to sell out of WA investment properties,” she said.

“The fall of 5000 rentals since last year has been an ongoing trend and the bonds data shows we’ve actually lost just over 19,000 rentals in the WA market since January 2021.

“The priority needs to be how we get those 19,000 investors to come back and a buy a property they will lease to someone else and, perhaps even more importantly, ensure that those people who do currently own a rental property, hang on to it and keep renting it out.”

A key factor concerning investors was legislative uncertainty, particularly around WA’s Residential Tenancies Act (RTA).

“The vast majority of rental stock in WA is owned by small, private investors,” Ms Hart said.

“After a five-year downturn for the property market, COVID struck and investors faced emergency restrictions and were in limbo for 12 months.

“The data is unequivocal about what happened next - as soon as the moratoriums on evictions and rent increases were lifted, investment property owners began a mass exodus from the WA market, which is what has meant there are now 19,000 fewer rentals in WA than in January 2021.

“Those that still have investment properties are listening to the debate over rental reform in WA, and they’re telling us they’re very nervous about some of the changes being considered.

“There are already significant pulls to exit the WA market with ten interest rate rises, a bulk of mortgages switching from variable to fixed-rates and a broad recovery in WA home values.

"Policy needs to prioritise the needs of the community, and what the WA community needs right now and over the coming years is people who own a home they are willing to lease to someone else.

“Mortgage repayments on a $500,000 loan are up 44 per cent since April 2022, while median monthly rents are up 17 per cent.

“While there is a perception that investors are hiking rents every time their mortgage goes up, the reality is they’re limited as to how often they can do this – every six months depending on the lease agreement. Calls on the government to limit this more would simply further diminish confidence in the regulatory environment and negatively impact investor sentiment.”

Pre-COVID, investors faced several tough years with rent prices declining and tenants regularly breaking leases to chase even cheaper rents.

“Pre-COVID investors were offering incentives, like a month’s free rent to attract new tenants,” Ms Hart said.

“Interest rates were going up, house prices were going down, many investors found themselves in negative equity and couldn’t sell if they wanted to.

“Now that prices have improved, they’re taking the opportunity to move on - but encouraging them to retain rental properties in the WA market is a significant part of the addressing our housing challenge so a reasonable approach to RTA reform is a key part of that.”

.tmb-rcarousel.jpg?sfvrsn=24ed8b20_1)