Housing affordability declines in WA: REIA

19 March 2024"WA was the most affordable state for housing, with only the ACT (35.2 per cent of family income) and the Northern Territory (33.0 per cent of family income) more affordable."

Rising house prices and interest rates have seen housing affordability decline slightly in WA however WA has retained its title as the most affordable state, according to the latest REIA Housing Affordability Report.

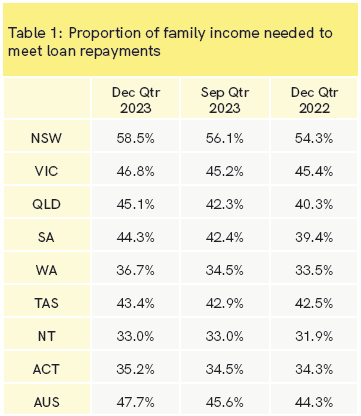

Affordability declined 2.2 per cent over the December 2023 quarter, with WA homeowners requiring 36.7 per cent of family income to meet loan repayments — 21.8 percentage points lower than the portion of income NSW homeowners require to meet their mortgage payments and 11.0 percentage points lower than the national average.

The analysis of affordability was based on a median weekly WA family income of $2,590 and an average WA monthly loan repayment of $4,123.

WA was the most affordable state for housing, with only the ACT (35.2 per cent of family income) and the Northern Territory (33.0 per cent of family income) more affordable.

At a national level, all states and territories saw a decline in affordability over the quarter, except for the Northern Territory which saw no change.

Queensland homeowners saw the largest decline in affordability with a 2.8 per cent drop, while New South Wales housing remained the least affordable in the nation, with homeowners now requiring 58.5 per cent of family income to meet loan repayments.

Nationally, the proportion of family income required to meet mortgage repayments reached 47.7 per cent in the December 2023 quarter, rising 2.1 percentage points over the quarter and 3.4 percentage points over the year.

Housing affordability is now at its lowest point in 20 years in New South Wales, Victoria, South Australia, Tasmania and the ACT.

REIWA CEO Cath Hart said demand for WA homes remained strong over the December quarter, underpinned by strong population growth.

“WA has a growing population that needs to be housed. There is high demand to buy established homes and they are selling quickly, currently in a median of eight days,” she said.

“Building has its own challenges. Costs have risen and construction times have blown out, making building less appealing.

“Rising interest rates have affected people’s borrowing capacity, making buying more difficult for some.”

Despite the challenges, Ms Hart said WA home buyers were well-equipped to navigate the changes.

“WA currently has the highest median weekly family income, with the exception of the ACT ($3,274),” she said.

“This is coupled with one of the lowest average monthly loan repayments, only behind Tasmania and the Northern Territory, puts WA home buyers in a better position to adapt to future changes in market conditions.”

Loan activity

The average loan in WA was $500,649 in the December quarter, an increase of 5.5 per cent from the September quarter and 4.4 per cent annually. WA’s average loan size was 18.5 per cent lower than the national average of $614,029.

The median weekly family income in WA was $2,590, higher than the national median at $2,445, while our average monthly loan repayment was lower at $4,123 compared to $5,057 nationally.

Although housing affordability decreased, the number of new loans increased 14.1 per cent to 10,787 in the December quarter. This was comparable to levels seen in the December 2022 quarter (10,537).

WA was one of the most affordable states for first home buyers with an average loan size of $436,848. This was an increase of 4.1 per cent over the quarter and 11.0 per cent annually. The Northern Territory ($412,393) and Tasmania ($402,091) were the only two states more affordable.

The number of loans to WA first home buyers rose 17.2 per cent to 4,277 over the three months to December and 6.7 per cent over the past year, making up 39.6 per cent of the state’s owner occupier market.

Rental affordability

Rental affordability in Western Australia declined over the quarter and over the year.

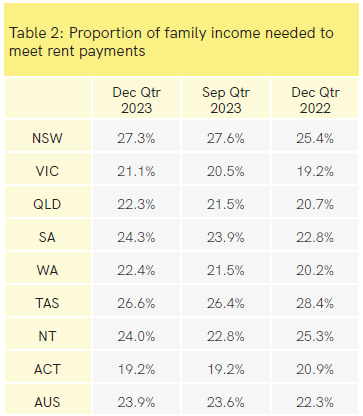

The proportion of family income required to meet WA’s median rent payments increased 0.9 percentage points to 22.4 per cent in the three months to December, an increase of 2.2 percentage points over the year.

This makes WA the third-most affordable state for rentals behind the ACT (19.2 per cent) and Victoria (21.1 per cent).

Affordability is at its worst in New South Wales, where 27.3 per cent of family income is needed to meet rent payments, an increase of 1.9 percentage points over the year.

Ms Hart said more increases were likely in the coming months as challenges in WA’s rental market continue.

“The key issue facing the rental market is supply,” she said.

“Rental supply has been declining while demand has remained strong. These factors are maintaining the pressure on rental prices. Until they ease, we are unlikely to see prices fall.

“We will see a change in the rental market when supply increases. When there is more competition and tenants have more choice, prices will decrease as has happened in the past.”

767bbbc6-4993-4f16-8933-e9b2baaac7a0.tmb-rcarousel.jpg?sfvrsn=8cf14270_1)